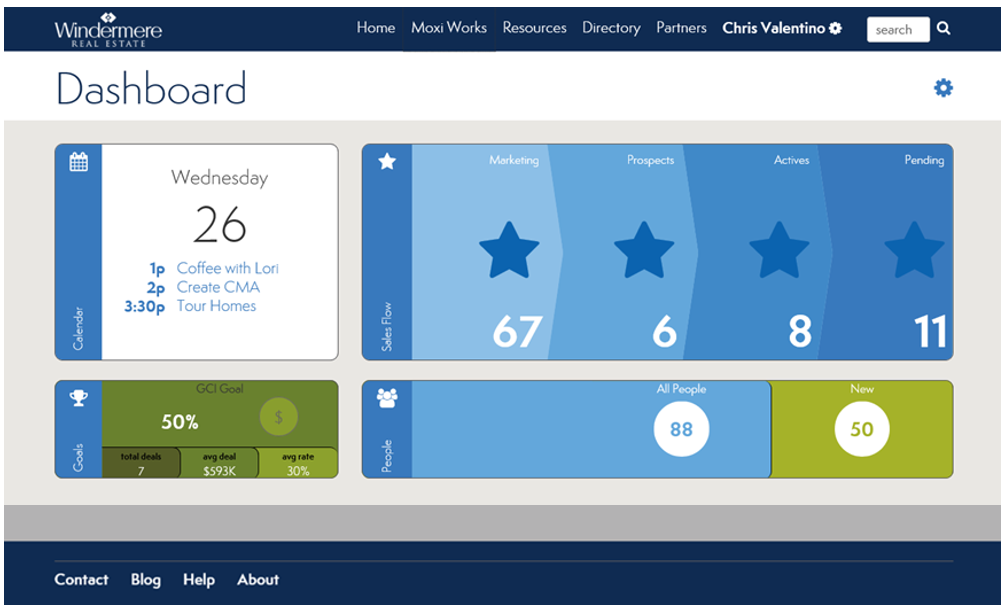

The simplified solution to an age old real estate problem; Moxi Works (formerly known as Broker in a Box) is your marketing plan for the year distilled into a beautifully automated, simple to use and fully mobile web based platform…

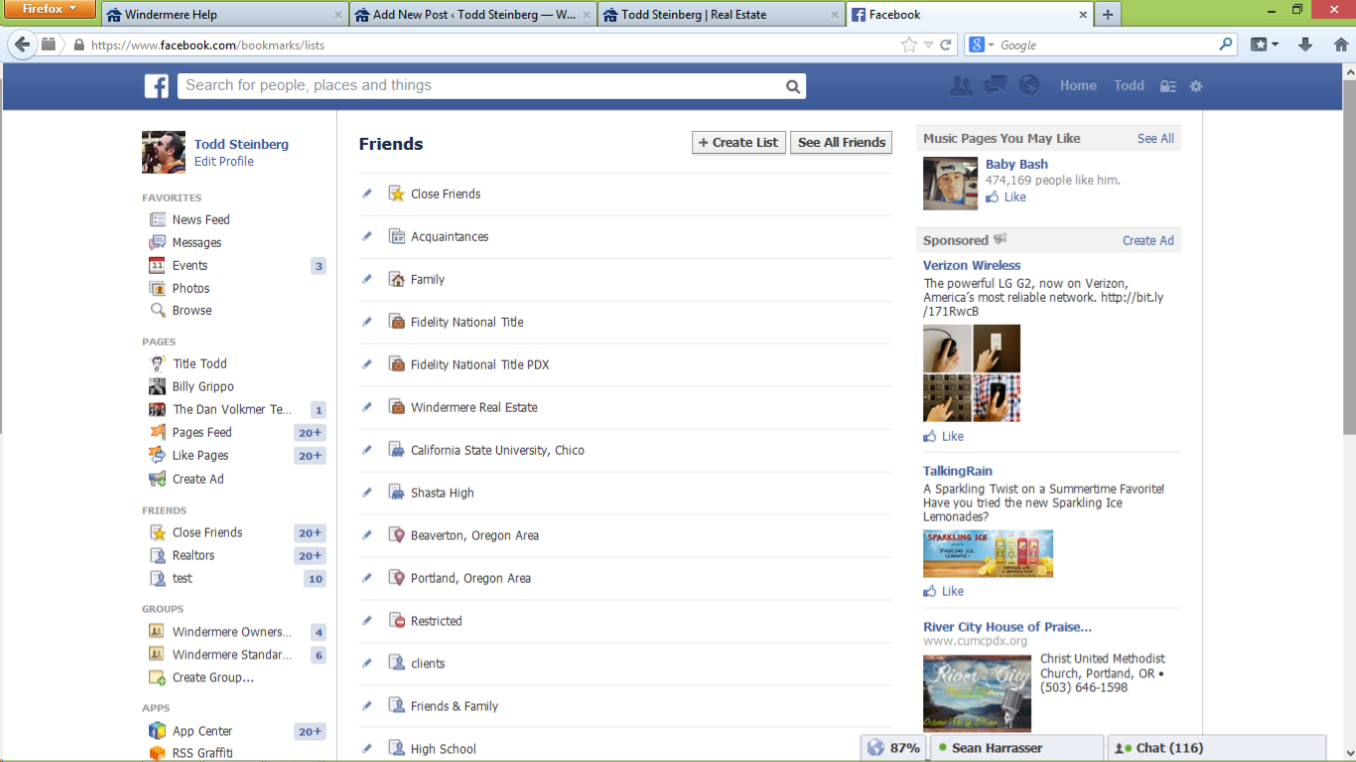

After years of fielding questions on what contact management tool agents should use to help them keep in communication and stay in the "sales flow" process with their clients, my answer was usually three fold. Are you a Buffini disciple? Are you extremely analytic in a "Top Producer" state of mind? Or, do you want to try something new and overly complicated? But none of those products were the sure fire solution to the problem of keeping an agent on top of their business and marketing goals for the year. Now, for my Windermere agent friends out there, I have only one answer, Moxi Works!!!

Yes, a new contact and sales flow management tool that is your automated marketing plan for the year and beyond; a site that is simple to use, visually pleasing, and mobile friendly that includes easy access to all of the tools and products you have come to love from Windermere. Using your contacts and the Microsoft 365 Exchange email platform, this tool will help you stay in the sales flow process with your clients from first contact to handing over keys and beyond, keeping track of and reminding you about important dates and tasks along the way. Moxi Works includes an automated email marketing piece, Neighborhood News, that can be set up with "one click" to go out to your prospects (warm leads) with a drill down piece that takes them directly to your agent website for a beautiful market stats piece built within your site!!!

Want more business for the year? This system includes a goal tracking piece that uses integrated MLS data along with a complex mathematical formula to keep you up to date on your current progress and what it will take to reach your target at the end of the year without you having to do any complex math yourself. In short, it's an automated coaching system for those who want to take their business to the next level, and best of all, the whole system is completely mobile friendly, no matter what device you use!!!

This is just the beginning; too much information all at once can be overwhelming, so much more will be coming in future updates… Did I mention that WORC (Windermere Online Resource Center) gets a much needed facelift in this whole process as well? YOU ARE GOING TO LOVE THIS!!!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Nothing in life lasts forever – and the same can be said for your home. From the roof to the furnace, every component of your home has a life span, so it’s a good idea to know approximately how many years of service you can expect from them. This information can help when buying or selling your home, budgeting for improvements, and deciding between repairing or replacing when problems arise.

Nothing in life lasts forever – and the same can be said for your home. From the roof to the furnace, every component of your home has a life span, so it’s a good idea to know approximately how many years of service you can expect from them. This information can help when buying or selling your home, budgeting for improvements, and deciding between repairing or replacing when problems arise.

Babies in need of diapers and formula. Families with critically ill children in need of housing. Kids with no shoes or school supplies. For the past 25 years, these are the types of needs the Windermere Foundation has helped fulfill, thanks to the incredible generosity of our agents. That’s because every time someone buys or sells a home using a Windermere agent, a portion of their commission goes to fund the Windermere Foundation, which to date has raised more than 26 million dollars.

Babies in need of diapers and formula. Families with critically ill children in need of housing. Kids with no shoes or school supplies. For the past 25 years, these are the types of needs the Windermere Foundation has helped fulfill, thanks to the incredible generosity of our agents. That’s because every time someone buys or sells a home using a Windermere agent, a portion of their commission goes to fund the Windermere Foundation, which to date has raised more than 26 million dollars. Whether you are buying or selling a home, mold has become a hot issue. Health concerns and potential damage make mold a red flag for buyers. And even if you’re not planning to sell any time soon, taking care of mold problems now can prevent even larger problems in the future. Contrary to what some people think, mold is not a geographic problem—it can occur anywhere, no matter where you live. Here is some basic information about mold and how to deal with it.

Whether you are buying or selling a home, mold has become a hot issue. Health concerns and potential damage make mold a red flag for buyers. And even if you’re not planning to sell any time soon, taking care of mold problems now can prevent even larger problems in the future. Contrary to what some people think, mold is not a geographic problem—it can occur anywhere, no matter where you live. Here is some basic information about mold and how to deal with it. The

The  Richard Eastern is a Windermere broker in Bellevue, WA and co-founder of

Richard Eastern is a Windermere broker in Bellevue, WA and co-founder of